Payoneer is the most popular online company that lets you send and receive cross-border payments & various Companies & Affiliate Networks are using it because it is the best cost-effective way for them.

Payoneer is the most popular online company that lets you send and receive cross-border payments & various Companies & Affiliate Networks are using it because it is the best cost-effective way for them.

In today’s post, you’ll learn how to withdraw money from the Payoneer account if you have any available balance/funds that you want to withdraw from your account. There are various methods through which you can withdraw funds & balance from your Payoneer account.

So that being said let’s get started with the very first thing you need to know is that there are various ways that you can use to withdraw money from Payoneer and basically Payoneer does allow you to withdraw money from your Payoneer account directly either to your bank account or using ATM Card also known as Payoneer MasterCard.

2 Best Ways to Withdraw Money from Payoneer Account

Basically, there are 2 major ways you can use to withdraw money from your Payoneer account. Before we go ahead, I’d like you to take a look at our how-to sign up for Payoneer guide if you have not yet applied for a Payoneer account also by using our exclusive affiliate link here, you’ll earn a free $35 to $50 sign up bonus today. You can also learn about the Payoneer $25 Sign UP Bonus to know why Payoneer is offering & providing a free registration bonus to every new user that wants to sign up for Payoneer.

So that being said, let’s move ahead to the two 2 major ways you can use to withdraw money from Payoneer.

1. Payoneer Mastercard Withdrawal

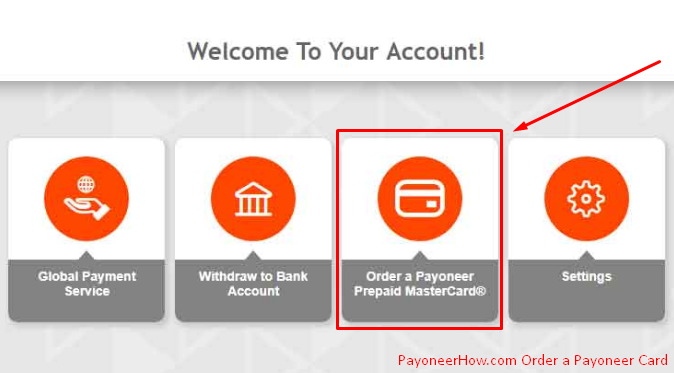

If you are registered for a Payoneer account then you might have already a Payoneer MasterCard and if you’re a new user/customer and yet didn’t order MasterCard/ATM Card for your account then you can easily order one for your account just by logging in into your account and ordering a card for your account.

Once you have ordered your card, it will take around 20 to 40 days to receive at your provided address and once it’s received, you can easily activate & link it with your Payoneer account.

Once the Payoneer branded MasterCard or ATM Card is linked, you can then use that card to withdraw money from your Payoneer account using any ATM across the world, make online & offline shopping, and much more.

However, there is a limit for withdrawing via Payoneer ATM. You can only make a small withdrawal transaction in one shot.

Payoneer Card Withdrawal Limit

The Payoneer Card can be used for shopping both online & offline & at ATMs for withdrawing money, however, there’s a limit on per ATM withdrawal which means you can’t withdraw more than $150 (or it might be different depending on the country & atm) in per transaction. Although, you can withdraw money multiple times using the Card from the same ATM.

Payoneer ATM Withdrawal Fees

Every time you make an ATM transaction via your Payoneer Card, Payoneer will charge you around $3.5 and if you’re withdrawing in a different currency i.e, from USD into PKR then there will be an extra 3.5% conversion fee as well.

2. Payoneer Bank Transfer

Withdrawing funds from Payoneer through Local Bank Transfer is the best & most admired feature of Payoneer which means that it lets you withdraw money from your Payoneer account directly to your bank account in your own country which further reduces the fees of the transaction. Instead of withdrawing through an ATM Card, withdrawing through Local Bank Transfer is way better than Withdrawing through ATM.

With the Payoneer Bank Transfer, you can add up to 3 bank accounts to your Payoneer account which means you can easily withdraw money from Payoneer using those bank accounts in your local currencies. However, there will be a 2% conversion fee on local bank transfers while withdrawing through Payoneer Card, there will be 3.5% conversion fee so withdrawing & transferring using a bank account is far better than ATM Withdrawal.

More Methods of Using Payoneer Money/Balance

Apart from these 2 major ways of withdrawing money from Payoneer, you can use your Payoneer Account for other purposes as well.

1. Online Shopping

With the help of Payoneer, you can make online purchases & shop. It’s an ideal service for Bloggers, Freelancers, Affiliate Marketers & those who work online & make money.

You can basically use Payoneer Card to make online purchases and you can easily purchase the following things.

- Internet-related products i.e Web Hosting, Domain Names, pay-for services online & much more.

- You can pay your invoices for the services & products you purchase.

- You can use Payoneer Card to make payments for your invoices online i.e Electricity Bills & Internet Bills etc.

2. Offline Shopping

In most cases, the ATM Card can be very helpful. For example, if you even don’t have any money in your pocket and you have a Payoneer Debit Card in which you have a balance/money available then you can easily make shopping & offline purchases anywhere where ATM Card is accepted for shopping. In most cases, you can get benefits from this feature in the following situations & stores.

- Stores & Hypermarkets

- Petrol Pumps

- Pay for Mobile Top-Up

- And also purchase other products

Related Posts:

I hope this guide helped you. Please do leave your comments below and also don’t forget to share this post with your social media friends & colleagues.

Thank you for the information.

I don’t know if you can help me. I’m thinking about opening a Payoneer account for receiving payment from one of my partners. I’m based in Italy and I have a multi currency account there. My partner will pay me in US dollar through Payoneer. What happen if I transfer money from Payoneer to my bank account? Do I have to pay the fixed 1.50$ fee or do I have to pay the 2% fee?

Thank you

nootan.nb88677108@gmail.com